Proposed Personal Wealth Protection Strategy Year-End Review

As noted by Arthur's post this information may not appeal to everyone within the FIGU Community and why it has been presented in the Off-Topic category open to any subject matter. This post is directed to folks within the FIGU Community interested in preserving their wealth by sharing a strategy that actually has worked historically in view of Billy Meier's warnings of economic uncertainty and as witnessed daily with higher cost-of-living relative to stagnate incomes.

Furthermore everyone needs to make a living in today's lack-luster economy therefore this topic may provoke thought and reflection to explore how best to preserve personal wealth in view of the world-wide worsening economy, constant inflation, weakening dollar, and growing unsustainable national debt in virtually every nation on Earth.

Billy has repeatedly warned mankind's foolish actions have wrought negative consequences on Earth including foretelling of economic turmoil. In

CR #691 Billy Meier's probability calculations, warns the following degenerations will take place on Earth:

Speculators will cause a global financial and economic crisis, the like of which has never been seen before, as a result of which the entire financial economy will be in great distress and there will also be much disaster and great shortages of economic goods.

Also in the USA the population shall get dispossessed as a consequence of the worldwide financial crisis, which will lead to the incensed and partly heavily armed population being advanced on by military and police powers with evil Gewalt.

All social systems worldwide will collapse, whereby more and more human beings will fall into deepest poverty, will no longer be able to enjoy health care and will also die of hunger and misery, because they will no longer be able to finance their entire livelihood and therefore also their own nutrition and health.

The pension institutions will no longer be able to pay out pensions because they are running out of funds, on the one hand due to the ageing of pensioners, on the other hand because the number of pensioners is increasing due to the growing mass of overpopulation and the overall cost of living is rising and with it the need for pensions, the increase and even payment of which will become increasingly questionable.

Many states will get into pecuniary distress due to senseless financial expenditures and overburdening, whereby the entire state structures and banks as well as the economy will collapse as a result of inevitable bankruptcy.

In

CR #543 Billy provides the following economic warning:

I cannot give you a clear answer to your question whether the whole world is going bankrupt, except that it is extremely unpleasant what is happening in all countries of the Earth on the financial markets, in governments and in the economy. But when I look at the whole thing, it seems that everything is going downhill, is getting worse and is heading for global financial and economic collapse if something does not change for the better soon.

Billy's warnings are abundant and may NOT occur provided leading world governments implement positive change particularly in the USA, however, overall the world-wide economy continues degenerating with no relief in sight.

Today, December 26, 2025, has been four months since the August 25

protect your wealth strategy was presented and now marks the opportunity to gauged its performance within the latter third of 2025. As the end of 2025 nears, both gold and silver have increased in value significantly in the last 4-months. The price of gold increased by $1,167.80 from $3,366.36 to $4,534.16 representing a 35% Return on Investment (ROI). Silver performed much better than gold increasing in value by $40.43 from $38.82 to $79.25 or 104% ROI. Anyone who invested in silver on August 25, 2025, would have, as of today, doubled their wealth in 4-months.

- Dec Price 1.gif (80.07 KiB) Viewed 121 times

Two scenarios are presented that demonstrate the benefit or unrealized gain from a $10,000 and $100,000 investment made on August 25 to December 26, 2025, four months later.

A $10,000 investment in gold & silver purchased four months ago if sold at the spot price today would be worth $15,732 resulting in a $5,732 profit. Considering silver outperformed gold in the last 4-months, a $10,000 investment in silver would be worth $20,391 today for a profit of $10,391. A $100,000 investment in silver, four months ago if sold today at the spot price at $204,107 would result in a $104,107 profit.

- Dec Price 2.gif (50.28 KiB) Viewed 120 times

The above proposed investment strategy not only preserved wealth but generated a significant unrealized gain in a relatively short time-frame however any investment is risky therefore its important first do the research to understand both the risk and rewards of any investment strategy. Do not blindly apply this method without first doing the required research to determine if its within your risk tolerance.

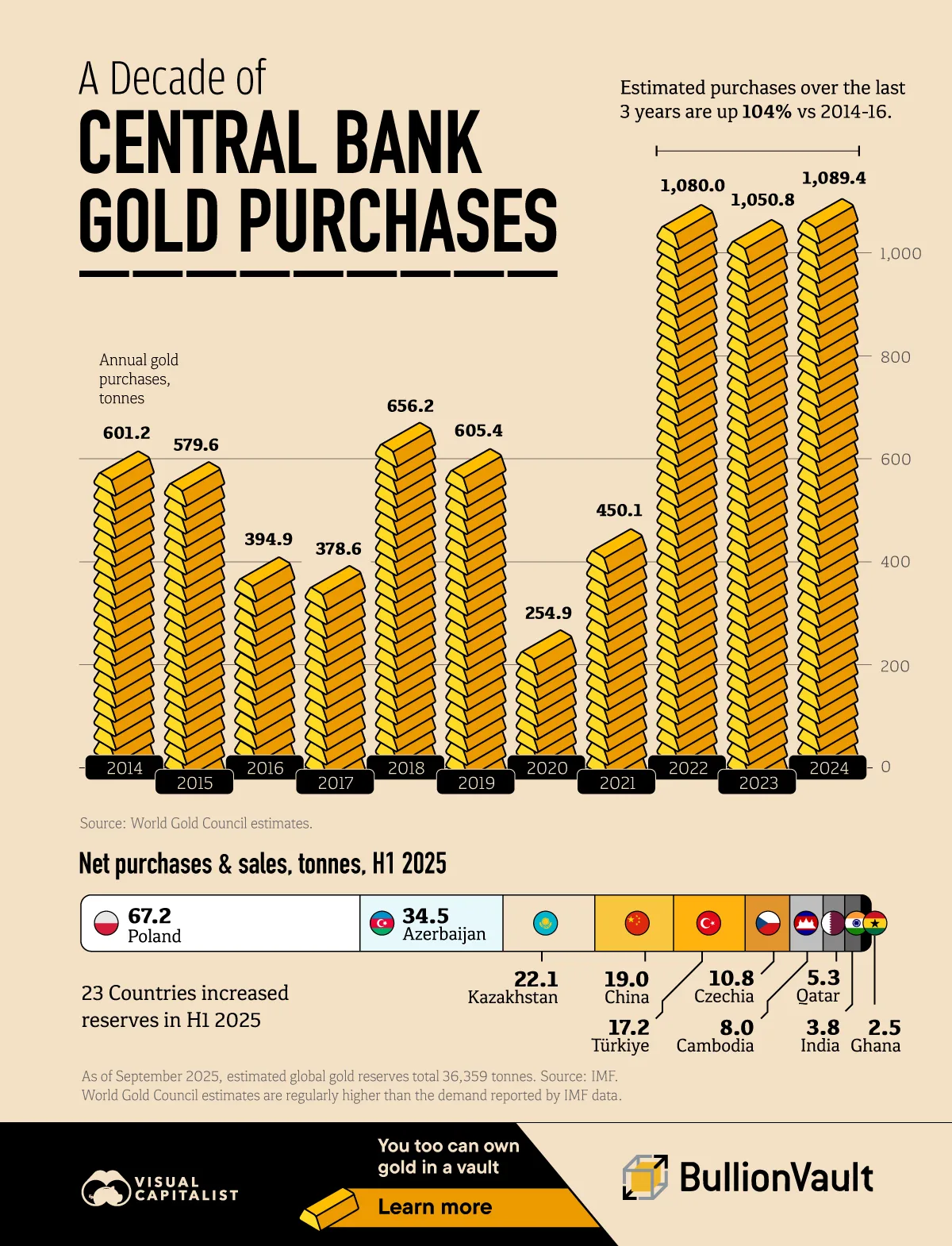

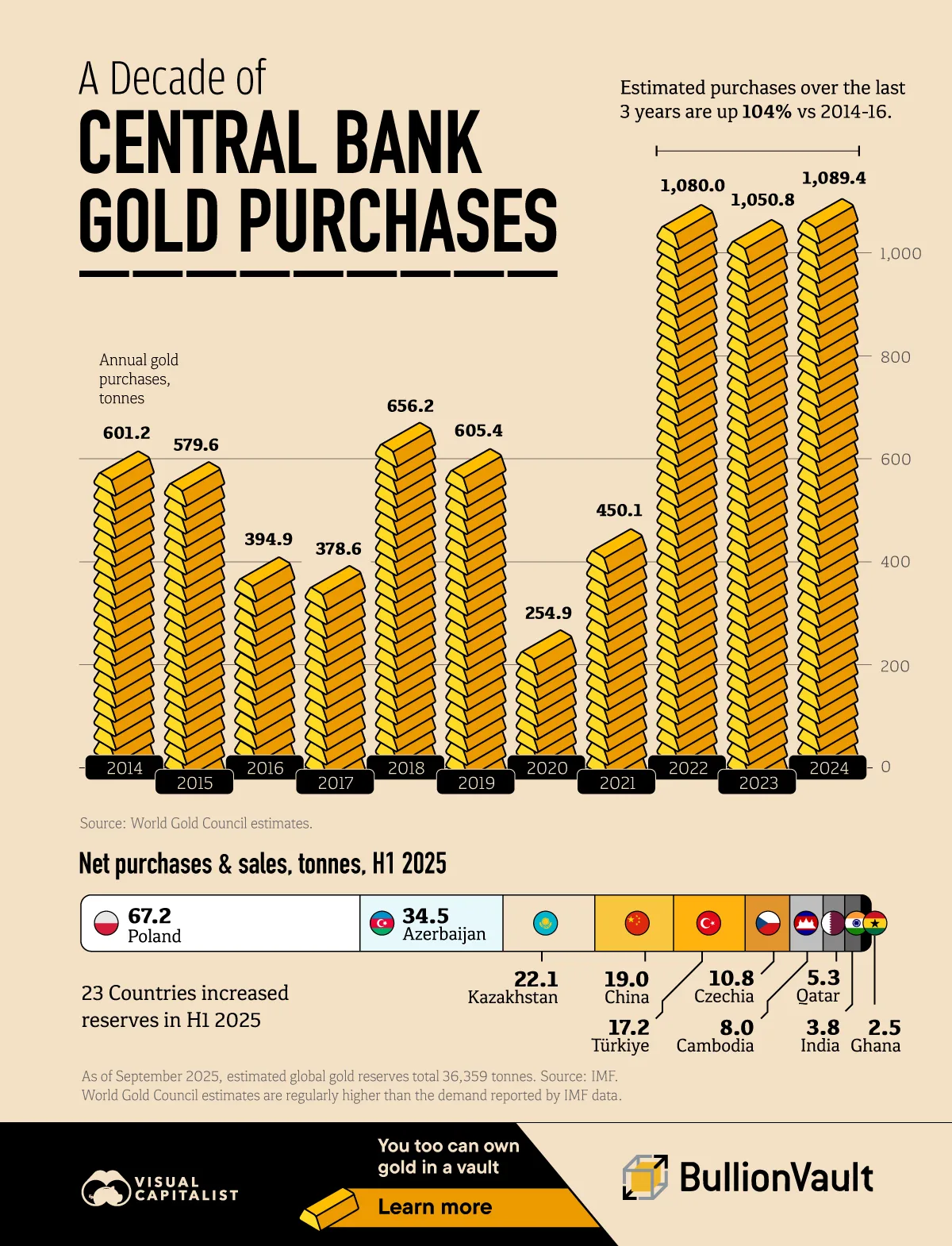

Part of the reason why this investment strategy remains viable is because precious metals are considered a hedge investment against economic uncertainty. And there seems to be a lot of concern in the world regarding the dire world economy. Wtihin the last few years the

world's central banks have been on a gold buying-spree driven by rising geopolitical tensions, widening imbalances, and a worsening debt outlook point to gold playing a more important role in the global economy.

The true value of cash continually erodes as inflation and prices rise unabated combined with a weakening dollar. As we gradually move towards a cashless society, for now at least, this investment strategy seemed to have worked well historically for the last 7-8 years however there is no guarantee the trend will continue although the experts suggest otherwise.

- Dec Price 3.gif (35.46 KiB) Viewed 121 times